NY Paid Family Leave Announcement

December 1, 2017 letter to all employees in regards to the New York Paid Family Leave. Important information, effective dates, deduction, contacts and resources

Federal Minimum Rate FLSA

Employee rights under the Fair Labor Standards Act

FMLA

Employee rights under the Family Medical Leave Act

Disabilities Minimum Wage

Employee rights for workers with disabilities paid at special minimum wages

NY Health Effects & Hazards

Your employer must inform you of the health effects and hazards of toxic substances at your worksite

Employee Polygraph Protection Act

Employee rights under the Employee Polygraph Protection Act

NY Public Notices

New York Public Notices for Smoking, Unemployment and Workers' Compensation

SSA Disability Insurance Notice

State Security Agency New York Disability Insurance information

Working Hours for Minors

You Have a Right to Temporary Changes to Your Work Schedule

NY Paid Family Leave Statement of Rights

State Security New York Paid Family Leave Statement of Rights and Insurance Notice

NY 2017 Minimum Wage

New York State 2017 Minimum Wage Hourly Rates

H-2A Program

Employee rights under the H-2A Program

NY Public Notices

Public notice blood donation leave and right to express breast milk

Job Safety and Health

OSHA - Occupational Safety and Health Administration Job and Safety Law Notice

USERRA

Your rights under USERRA - The Uniformed Services Employment and Reemployment Rights Act

Pay Transparency

Stop Sexual Harassment Act Notice (English)

NY Fringe Benefits & Hours

New York State Department of Labor Division of Labor Standards Guidelines Notice Requirements for Fringe Benefits and Hours

NY Fringe Benefits & Hours

You Have a Rigfht to a Predictable Work Schedule

Workers Comp Prescription

Workers Compensation Prescription - Your company’s workers’ compensation insurance carrier is The New York State Insurance Fund (NYSIF) which has a contract with CVS Caremark, a pharmacy benefits manager (PBM) that offers convenient prescription filling services.

NY Division of Human Rights

THIS ESTABLISHMENT IS SUBJECT TO THE NEW YORK STATE HUMAN RIGHTS LAW (EXECUTIVE LAW, ARTICLE 15)

NY Law Correction Article 23-A

LICENSURE AND EMPLOYMENT OF PERSONS PREVIOUSLY CONVICTED OF ONE OR MORE CRIMINAL OFFENSES

Equal Employment Opportunity

Private Employers, State and Local Governments, Educational Institutions, Employment Agencies and Labor Organizations Applicants to and employees of most private employers, state and local governments, educational instituti ons,employment agencies and labor organizations are protected under Federal law from discrimination on the following bases

SSA Worker's Comp Insurance

State Security Agency Worker's Compensation Insurance Information

Pay Transparency

Pay Transparency Nondiscrimination Provision

NY Deduction From Wages

AVISO SOBRE LA LEY PARA DETENER EL ACOSO SEXUAL

NY Deduction From Wages

New York State Department of Labor Division of Labor Standards - Deduction from Wages Section 193 of the New York State Labor Law

Working Hours for Minors

Permitted working hours for minors under 18 years of age

ANNOUNCEMENTS

New Commuter Benefits

Beginning March 1, 2017, State Security Agency Commuter Benefits will now be provided by ADP.

COMMUTER SPENDING ACCOUNTS TRANSPORTATION AND PARKING

Save Money on Your Commute Use pre-tax money to save on eligible commuting expenses:

• Bus

• Parking

• Subway

• Train

What is a CSA?

- An employee benefit that saves you money on eligible parking and transportation expenses.

- Lets you pay for certain commuting expenses with pre-tax money on a monthly basis.

- A great way to LOWER your taxable income.

THERE ARE TWO TYPES OF CSAs:

- The Transportation Spending Account is used to pay for eligible mass transit or vanpool* expenses associated with travel to and from work, including bus, train or subway.

- The Parking Spending Account is used to pay for eligible parking expenses either near your place of employment or at a location from which you commute to work via mass transit or vanpool.

- *Generally, a vehicle is eligible for vanpool expenses if it seats at least six adults (not including the driver) and at least 80 percent of its mileage is used to transport employees to and from places of employment.

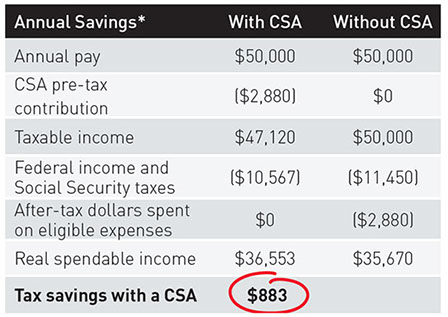

How will a CSA save me money?

You pay less in taxes. Here’s an example:

“I contribute $240 per month to my CSA to pay for commuting expenses. By using pre-tax money, I’m saving more than $800 a year.

CSA Participant

How do I know if I'm eligible to enroll?

You are eligible if you take mass transportation, participate in a vanpool, or have parking expenses related to your commute to and from work.

Note: This is a month-to-month benefit. You can enroll, change or cancel it at any time.

What are the dollar limits on tax-free transit and parking benefits?

Because both accounts are pre-tax benefits, the IRS limits the amount you may allocate to each account. The limits are determined each year by the IRS. Ask your human resources representative for the current commuter spending account limits.

How do I use my CSA?

Your card can be used for debit or credit transactions to make qualified transit or parking purchases. Purchases can be made where Visa® is accepted by selecting “Credit or Debit” at the time of purchase. Your card cannot be used for cash advances or to make cash withdrawals.

Can I combine the dollar limits from month to month?

No. The specified limits for transit, parking and vanpool apply individually to each calendar month.

What happens if I have a remaining balance in my account after six months (or if I leave the company)?

CSA participants have 180 days from the date of their last contribution to use their CSA debit card to purchase Transit or Parking benefits. If an employee is leaving the company, they will have up until their last day to use their CSA debit card to purchase Transit or Parking benefits. CSA participants may also submit Parking claims during this timeframe.

How do I enroll?

Determine what you typically spend monthly on qualified commuting expenses. Then, enter your per pay period deduction amount through your employer’s Benefits Enrollment Module. Your available account funds are loaded on your card following each payroll cycle and are available immediately.

Complete

NY Paid Family Leave Announcement

December 1, 2017

Dear Employee,

You may have heard or read about the new New York Paid Family Leave law (PFL) that has passed. While the new law doesn’t go into effect until January 1, 2018, it presents some important changes for you and your family. We have prepared this summary for you so that you are aware of your rights under the law. Let’s start with the basics:

What is the New York Paid Family Leave Law?

New York Paid Family Leave (PFL) is job-protected, paid time away from work mandated by New York State. That means eligible employees may take NY PFL:

• to take care of a seriously ill family member;

• to bond with a newborn, adopted, or foster child;

• or to attend to family issues related to a qualifying military deployment.

Who is eligible?

Every employee working full time (20 or more hours per week) in the state of New York is eligible for coverage after 26 weeks of consecutive employment. Part-time employees are eligible after 175 days of employment. Every employer is required to comply.

What is the benefit?

The New York PFL benefit for 2018 is set as follows:

• 50% of your average weekly wage, not to exceed 50% of the New York State average weekly wage, for a maximum of 8 weeks

However, the benefit is set to increase each year for the following three years, as follows:

• 2019 55% of average weekly wage for a maximum of 10 weeks

• 2020 60% of average weekly wage for a maximum of 10 weeks

• 2021 67% of average weekly wage for a maximum of 12 weeks

Who pays for the program?

The state has mandated that all employees will pay for the new coverage through payroll deduction at a rate of 0.126% of your weekly wages, not to exceed the statewide average weekly wage. As of right now, that average is $1,306, which means your deduction will not exceed $1.65 per week. This cap means that while your actual contribution is dependent upon your wages, it will not exceed $85.56 for all of 2018. Deduction for SSA eligible employees will automatically start December 7, 2017.

Opting out

You can only opt out of Paid Family Leave if you do not expect to work for your employer for the minimum amount of time required for eligibility. If you meet one of the criteria below and wish to opt out, you can do so by completing a Paid Family Leave waiver, which is available here (http://www.statesecurityagency.net/NY-PFL-Opt-Out-Form.pdf). A waiver of family leave benefits may be filed when:

• Your schedule is 20 hours or more per week, but you will not work 26 consecutive weeks; or

• Your schedule is less than 20 hours per week and you will not work 175 days in a 52-consecutive week period.

Health insurance benefits.

Under the NY PFL law, employees are entitled to continue their group health insurance benefits during their covered leave. Employees will be responsible for continuing to pay their share of insurance premiums during this period.

Welcome to State Security Agency's Company Page

We are pleased to announce our new mobile Time & Attendance process through the ADP App.

Introducing ADP Mobile Payroll App

As State Security Agency, LLC employees your time and attendance is now being tracked through ADP’s Mobile Payroll App for smartphones. It is available in Web, iOS, Android and Blackberry versions and have the following features:

- See your payroll info: employees can view pay statements from up to five previous pay periods, toggling between Net Pay and Gross Pay year-to-date screens.

- Clock in with Time & Attendance: SSA employees are required to clock in, clock out, indicate if they are running late to work, or if they anticipate being absent for illness, and create time sheets directly from their mobile devices. Employees’ smartphone location must be enabled within 20 feet of assigned work location’s address for employee’s location and time to be validated for clock in to be entered as attendance.

- Access the company Intranet: The company directory provides the ability to view, search,and contact employees listed in the directory. Links to phone, location and email fields are active and will call/email your contact or bring you to a map,as you would expect in a phone app. The company news feature allows employees to read news and events from their smartphone using RSS feeds.

ADP Mobile Solutions keeps you connected to company information. It provides a convenient way to access payroll, time & attendance, benefits and other vital HR Information.

KEY EMPLOYEE FEATURES:

- View pay and W2 statements

- View and request time off

- Track time and attendance

- Punch in and out

- Create timesheets

- Update, edit and approve time cards

- View benefit plan information

- Contact colleagues

Please visit the following website to learn more about the ADP Mobile Solutions applications: www.adp.com/gomobile

Watch video and get instructions on how to set up your ADP access for the first time by clicking HERE

Licensed by the New York State Department of State | New Jersey License Number 1667

Copyright © 2017 State Security Agency | All Rights Reserved | Powered by Barbelo Designs | Member of the IESA Network | License Number: 11000176562